Copyright © 2003-2025 Red Rock Capital, LLC. All rights reserved.

The risk of loss in trading commodities & futures contracts can be substantial. You should therefore carefully consider whether such trading is suitable for you in light of your financial condition. The high degree of leverage that is often obtainable in commodity trading can work against you as well as for you. The use of leverage can lead to large losses as well as gains. In some cases, managed commodity accounts are subject to substantial charges for management and advisory fees. It may be necessary for those accounts that are subject to these charges to make substantial trading profits to avoid depletion or exhaustion of their assets. The disclosure document contains a complete description of the principal risk factors and each fee to be charged to your account by the Commodity Trading Advisor. The regulations of the Commodity Futures Trading Commission require that prospective clients of a CTA receive a disclosure document at or prior to the time an advisory agreement is delivered and that certain risk factors be highlighted. This document is readily accessible from Red Rock Capital, LLC. This brief statement cannot disclose all of the risks and other significant aspects of the commodity markets. Therefore, you should thoroughly review the disclosure document and study it carefully to determine whether such trading is appropriate for you in light of your financial condition. The CFTC has not passed upon the merits of participating in this trading program nor on the adequacy or accuracy of the disclosure document. Other disclosure statements are required to be provided to you before a commodity account may be opened for you.

Testimonials are not indicative of future performance or success.

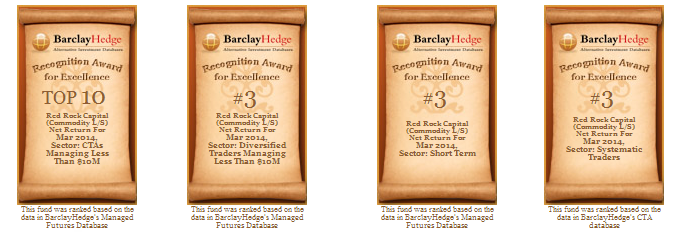

Red Rock Capital’s Commodity Long-Short Program was honored in March 2014 with multiple awards for excellence in performance by industry-leading database BarclayHedge:

Awards & Accolades

"The success of Red Rock Capital's systematic commodities program comes during a period when a number of high-profile commodity funds have closed shop and J.P. Morgan, Deutsche Bank, and most recently Barclays have all announced exits from the global commodity trading business."

- CTA Intelligence

"Congratulations on winning at the 2015 CTA U.S. Performance Awards! It's always nice when your hard work and performance are recognized within the industry."

- Arthur F. Bell

In June 2014 Red Rock Capital received two Alternative Investment Awards from

Wealth & Finance International:

• Commodity Investment Management Firm of the Year – USA

• Best Total Return Fund – North America

Winner of CTA Intelligence US Performance Awards 2015 — Best Emerging Manager (12-36 months)

Named one of the Top 12 CTAs for 2015 in October 2014 CTA Intelligence

In September 2014, and again in early 2015, Red Rock Capital's Systematic Global Macro program was selected to be a constituent in the HFRI Indices.

HFRI is the Institutional Standard for hedge fund managers and investors and remains the premier global hedge fund performance benchmark world-wide.

Winner of AI 2016 Hedge Fund Award for Best Tactical Commodities Portfolio Manager - USA

Winner of CTA Intelligence US Performance Award 2016

For 2016, Red Rock Capital's Systematic Global Macro program was again selected to be a constituent in the HFRI Indices.

HFRI is the Institutional Standard for hedge fund managers and investors and remains the premier global hedge fund performance benchmark world-wide.

Finalist in CTA Intelligence US Performance Award 2017

Red Rock's Commodity Long-Short Program recognized as a Top-Performing CTA by Preqin

Red Rock's SGM awarded Best Systematic Commodity Program (10 years) by Wealth & Money Management in July 2016

Red Rock Capital has been named a finalist for Investment Management - Advisory Firm of the Year 2018

Red Rock Capital’s Commodity Long-Short program won six different performance awards in July & Dec 2017

There are inherent limitations associated with awards and rankings. Database services such as BarclayHedge are composed of only those CTAs that submit performance to them, so they do not represent the entire universe of CTAs.

Red Rock Capital's Systematic Global Macro program named Most Innovative Systematic Global Macro Hedge Fund 2019 by Wealth & Finance International

Red Rock Capital's Commodity Long-Short Program has won multiple performance awards during the 2021 - 2024 period

| ||||

Systematic Commodity Trader

Best Performing Manager in 2023 and over 3 and 4 years

Commodity Long-Short Program

Red Rock Capital's Commodity Long-Short Program was named Best Performing Manager in 2023 and over 3 and 4 years by the hedge fund journal

In February 2025 Nasdaq's eVestment database recognized Red Rock Capital's Commodity Long-Short Program as a Top Performer for 3 year returns